Using Payment Processing Software for Your Business!

Payment processing software is an essential tool for businesses in today’s digital age. It helps companies manage and process their financial transactions, providing a more efficient and secure way to handle payments. But what is a payment system, and how does it work? In this page, we’ll explore the benefits, features, and considerations of payment software, so you can choose the best solution for your business needs.

Defining Payment Processing Software

First, let’s define what payment processing software is. It’s a tool that enables businesses to process and manage their payments securely, both online and in-store. Payment software helps with payment acceptance, transaction processing, customer data storage, and accounting management. It simplifies the payment process for both the consumer and the business, making it a crucial tool for any company.

Additionally, a payment software is important for businesses because it reduces the risk of errors associated with manual payment process. It also provides businesses with detailed financial management data that can help to streamline accounting processes and improve business performance.

Features, Benefits, and Considerations:

Features of Payment Processing Software

There are a few essential features that payment systems offers. First, it provides secure storage of customer data, which helps to protect against data breaches and identity theft. Secondly, it simplifies payment acceptance by allowing businesses to accept payments via a variety of channels, including online and mobile devices.

The tool also automates accounting and payment management, which can save businesses time and money. Additionally, a processing software offers faster reconciliation capabilities, providing businesses with access to transaction information in real-time.

How Payment Software System Benefit Businesses

Payment systems offers a range of benefits to businesses, including improved financial management, increased productivity and efficiency, enhanced customer experience, cost-effective payment process, and reduced risk of errors. By leveraging these benefits, businesses can improve their overall performance and profitability.

For instance, payment systems can help businesses to optimize their financial management by providing detailed data on transaction processing, customer behavior, and market trends. It can also support businesses to provide a better customer experience by offering a variety of payment options, such as digital wallets and mobile payment solutions.

Factors to Consider When Choosing a Payment System

When it comes to selecting payment software for your business, several factors need to be considered, including pricing structure, level of security, user-friendliness, available integration and compatibility, and customer support. Businesses need to ensure they select the correct payment system that offers the right level of security, is easy to use, and is compatible with their existing systems and processes.

It’s also essential to select a processing software that offers affordable pricing, which sometimes includes hidden fees such as setup costs, transaction fees, and chargeback fees. Customer support is another crucial factor to consider, as businesses need to have access to reliable and responsive support whenever they face any issue.

How Payment Processing Software Works

To understand how payment software works, it’s essential to understand how payment systems works in general. Payment applications facilitates transaction processing by working as a middleman between the merchant (business) and the customer. The software ensures that customer data is secure and that the payment is authorized and appropriately processed.

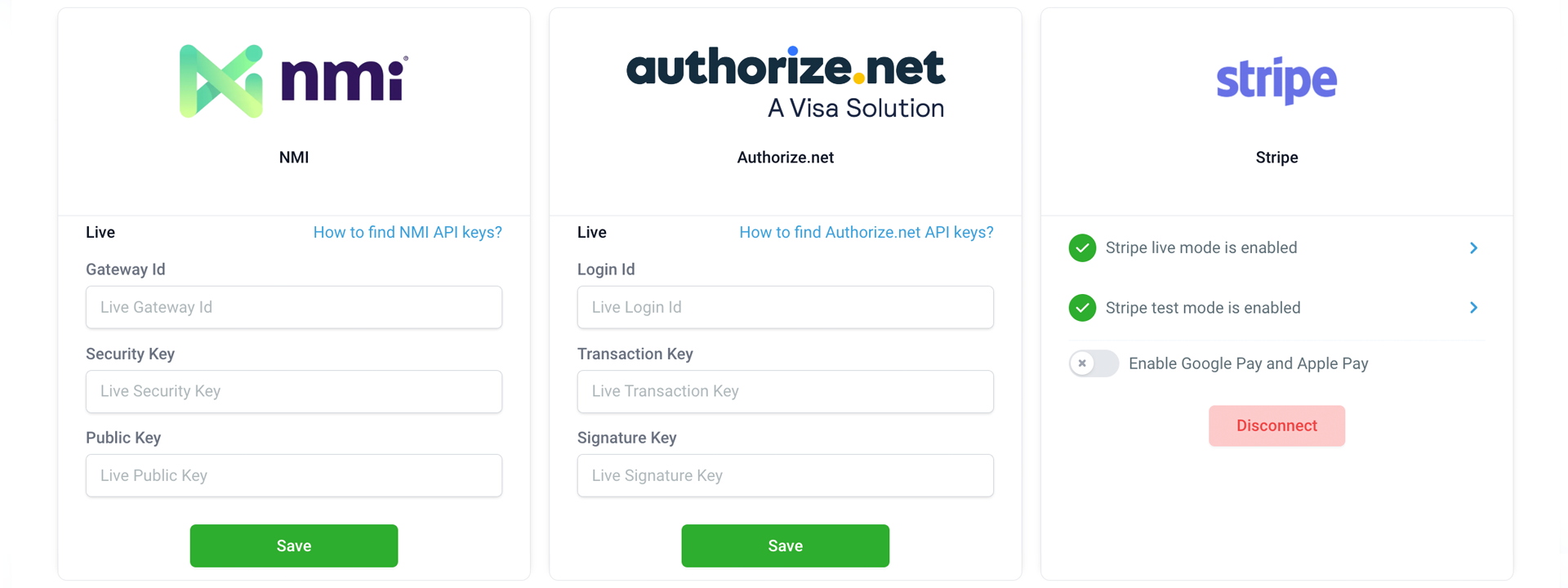

Payment software typically includes key components such as a payment gateway, merchant account, and authorization process. There are three primary types of payment processing models: hosted payment applications, integrated payment processing, and fully-automated payment processing. Payment software also typically includes security features such as encryption, PCI compliance, and fraud detection.

In conclusion, payment processing software is an essential tool for businesses of all sizes and industries. With secure storage of customer data, simplified payment acceptance, faster reconciliation capabilities, and automation of accounting and payment management, the processing software can help businesses to improve their financial management, productivity and efficiency, and overall customer experience.

When choosing payment software, businesses need to select software that is secure, user-friendly, and compatible with their existing systems and processes. They should also look for software that offers affordable pricing and reliable customer support. By selecting the right processing software, businesses can enjoy a range of benefits that can help them improve their overall performance and profitability.

Need A Consultation?

Schedule a consultation today to discuss your project.